by Alan Rhode | Aug 22, 2017 | Uncategorized

24 U.S. states have already joined the Voluntary Disclosure Program for online merchants who have failed to register for sales/use/income/franchise tax in the U.S. on sales carried out via marketplaces. The Program has been...

by Alan Rhode | Aug 16, 2017 | Uncategorized

For some months now, Linkedin and San Francisco-based HR platform hiQ have been arm-wrestling on the legitimacy of hiQ’s practice to collect and process data belonging to LinkedIn users’ publicly available profiles...

by Alan Rhode | Aug 16, 2017 | Uncategorized

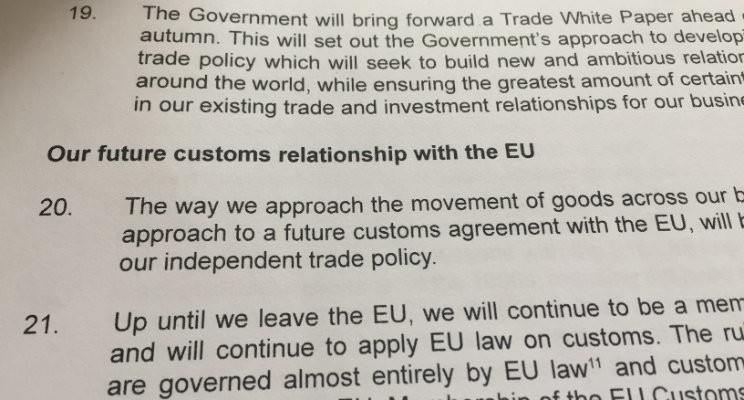

Yesterday, the UK Government publicly released a paper addressing the future country’s customs relationship with the European Union after Brexit. Despite the paper’s timing of release – on a day when many...

by Alan Rhode | Aug 10, 2017 | Uncategorized

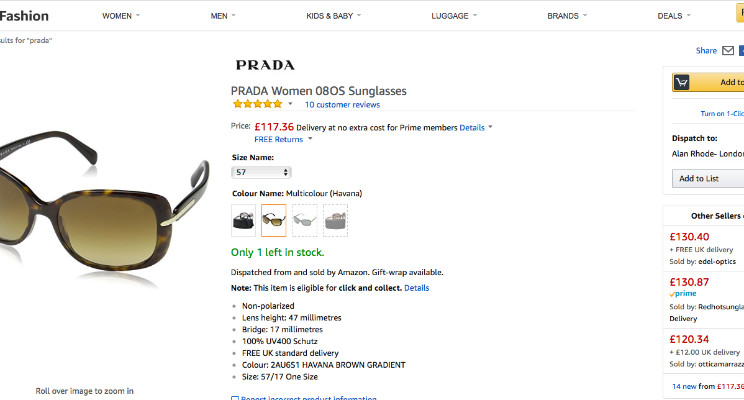

The high rate of product returns is one of the major issues for e-commerce stores globally. In Europe, all countries require merchants to grant a minimum 14-day cooling off period to consumers, when the latter can return products bought...

by Alan Rhode | Aug 3, 2017 | Uncategorized

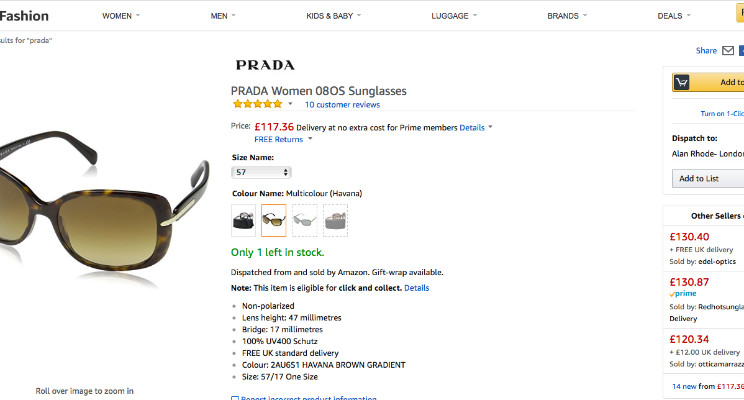

A decision of the European Court of Justice (ECJ) on whether luxury brands can lawfully forbid distributors from using marketplaces to sell their products is expected soon (Case C-230/16 – Coty...

Recent Comments