da Alan Rhode | Feb 13, 2017 | Uncategorized

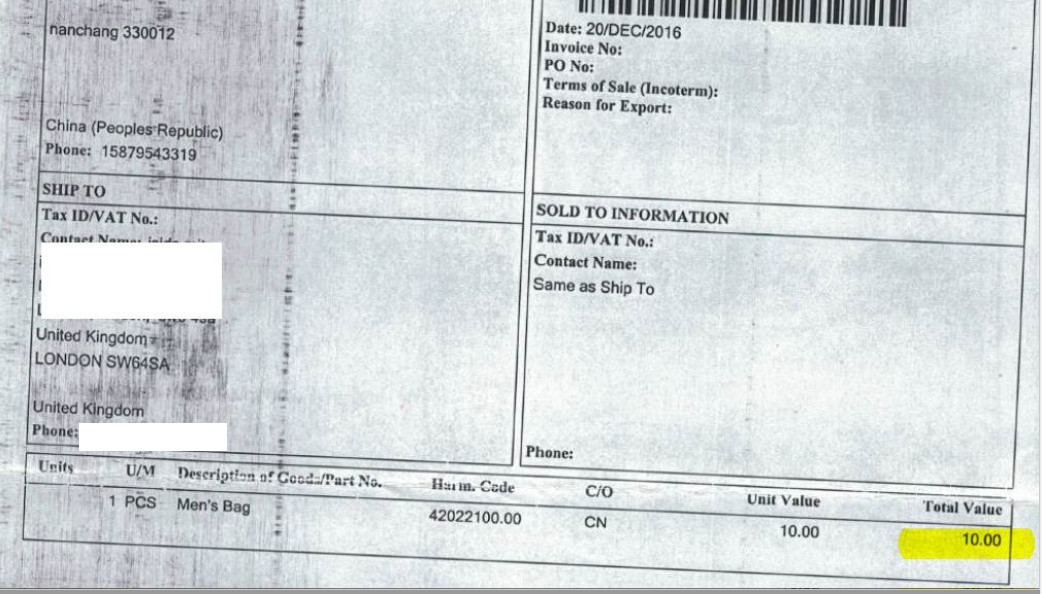

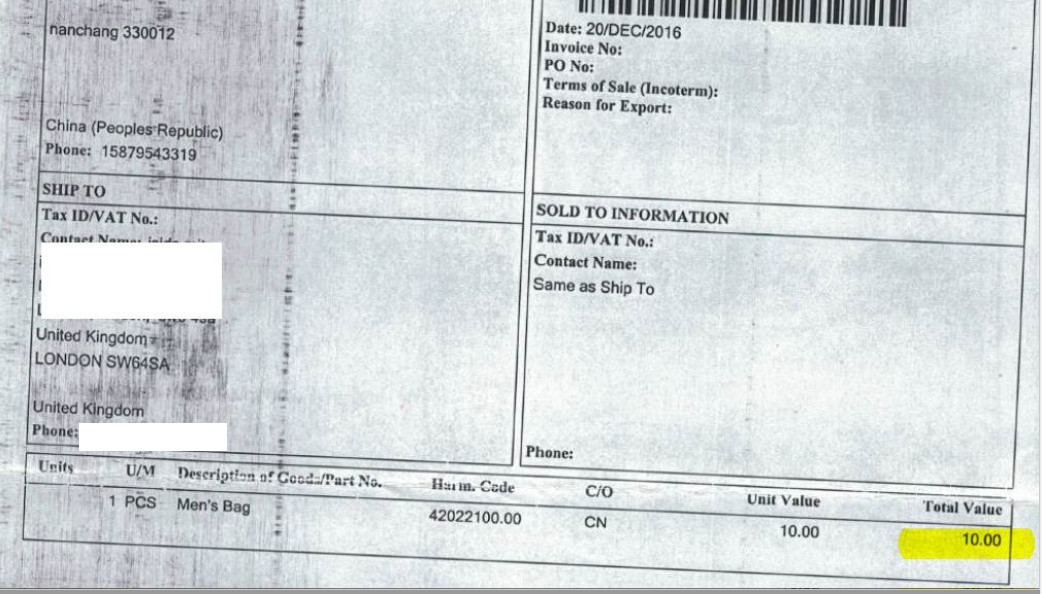

The reason is that foreign sellers exploit the so-called “small consignment exemption” set forth by EU law, whereby parcels with a declared value of less than 10 Euros are not subject to customs or import VAT at the EU border. So, millions of parcels every...

da Alan Rhode | Feb 3, 2017 | Uncategorized

Most European online shoppers do not realise that they are often evading taxes – meaning customs duties and import VAT – on shipments received from non-EU countries. And they risk liabilities and sanctions. The reason is that foreign sellers exploit the...

da Alan Rhode | Gen 31, 2017 | Uncategorized

After investing years of my life on providing tax and legal advice almost exclusively to e-commerce stores, I have decided to write down some ideas related to the performance of European e-commerce stores. Without the presumption of being a digital strategist or...

da Alan Rhode | Gen 28, 2017 | Uncategorized

The 28th of January 2017 is the Data Protection Day! It is the right occasion to remember that 2018 will see the new General Data Protection Regulation becoming effective. Regulation (EU) 2016/679 will indeed apply from 25 May 2018. It shall introduce one single set...

da Alan Rhode | Gen 26, 2017 | Uncategorized

amebay.com has just published an article on a very important regulatory framework for European merchants (with our support Sellers are rarely aware that most European countries impose an obligation on online merchants, including those established abroad, to report and...

Commenti recenti