da Alan Rhode | Giu 22, 2017 | Uncategorized

A transcript of my answers to the Q&A made during the workshop “ Proposal For New VAT Rules For Cross-Border E-Commerce: How Could It Benefit Online Shops”? at the 2017 Global Summit in Barcelona. Alan: is there anything missing in the Commission’s proposal that...

da Alan Rhode | Giu 2, 2017 | Uncategorized

Today is the deadline for stakeholders to submit their observations on a proposed system to extract VAT on online sales in real time using payment technology and depositing it with HMRC. The call for evidence can be found here:...

da Alan Rhode | Mar 30, 2017 | Uncategorized

We are here reproducing an article published on Tamebay.com with our contribution With the aim of tackling the long-discussed issue of VAT evasion related to ecommerce sales, HMRC is considering to introduce a “split payment mechanism” on sales made by...

da Alan Rhode | Feb 13, 2017 | Uncategorized

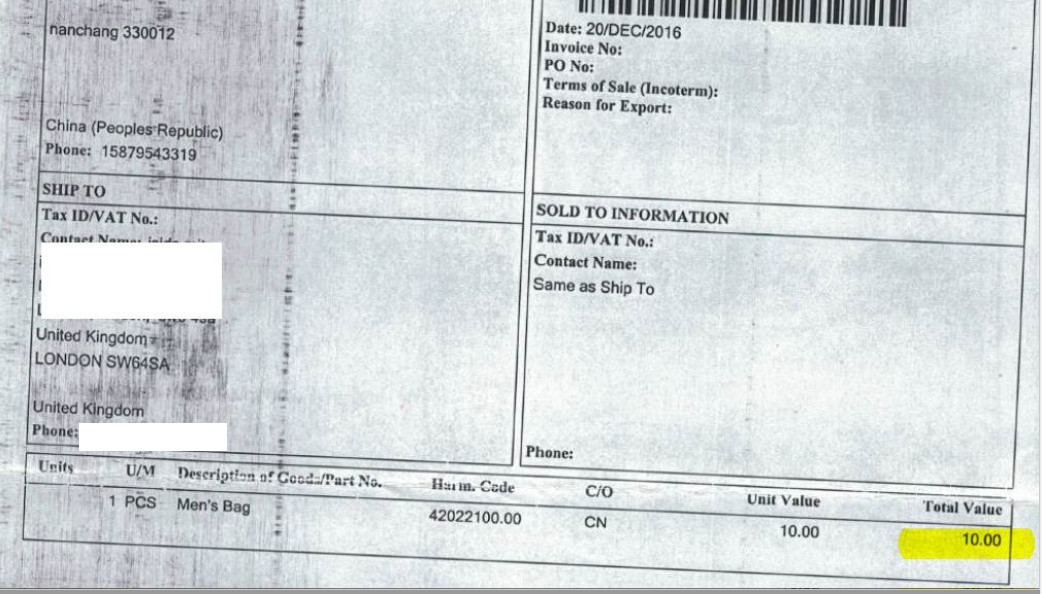

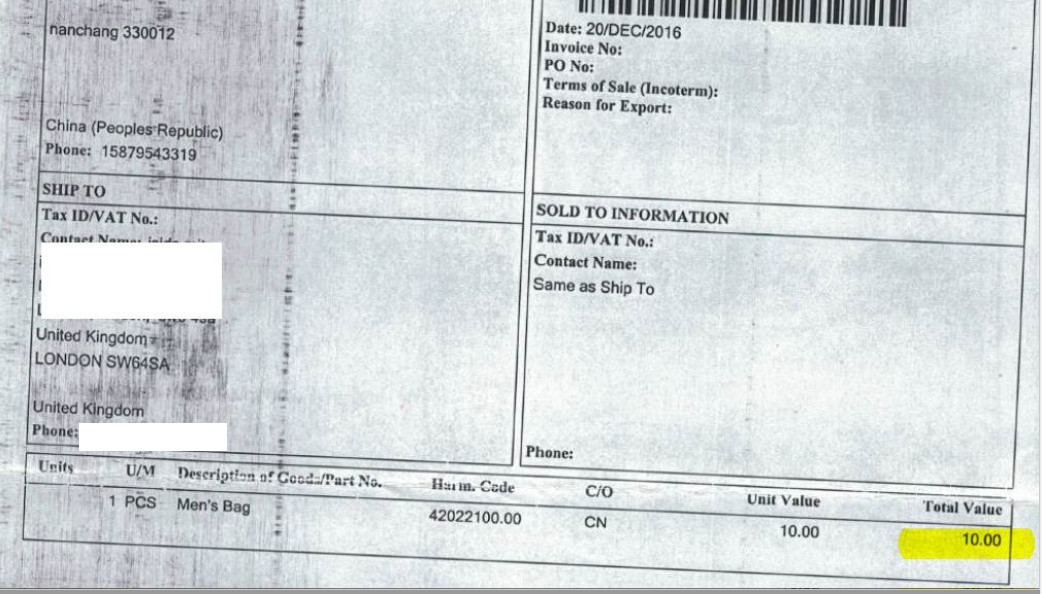

The reason is that foreign sellers exploit the so-called “small consignment exemption” set forth by EU law, whereby parcels with a declared value of less than 10 Euros are not subject to customs or import VAT at the EU border. So, millions of parcels every...

da Alan Rhode | Feb 3, 2017 | Uncategorized

Most European online shoppers do not realise that they are often evading taxes – meaning customs duties and import VAT – on shipments received from non-EU countries. And they risk liabilities and sanctions. The reason is that foreign sellers exploit the...

da Alan Rhode | Gen 31, 2017 | Uncategorized

After investing years of my life on providing tax and legal advice almost exclusively to e-commerce stores, I have decided to write down some ideas related to the performance of European e-commerce stores. Without the presumption of being a digital strategist or...

Commenti recenti